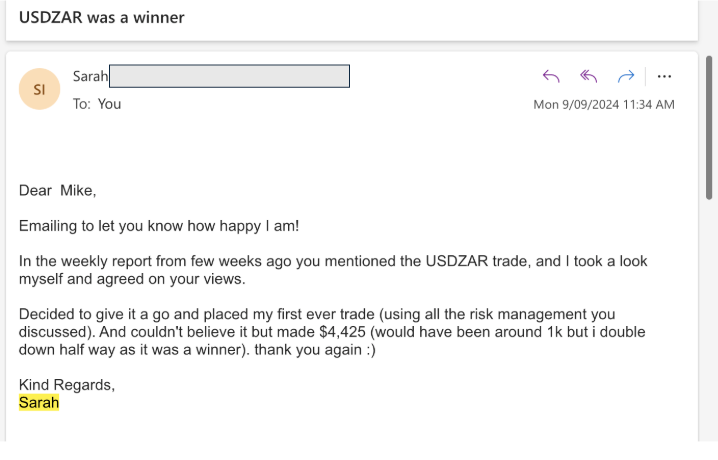

Sarah R. - Seattle, WA

Our risk management system turned a good trade into an excellent trade for Sarah. She went long USDZAR with half a position. Sarah bought at 17.890 with a stop loss at 17.658 and a soft profit target at 18.533. A few days later, the trade moved in her favour, hitting her target. Instead of exiting, she noticed strong momentum and no fundamental changes. She locked in profit by raising her stop to 18.306 and doubled her position by adding another half lot at 18.533. USDZAR kept climbing, and she exited at 19.020, making $4,425 in a few days.